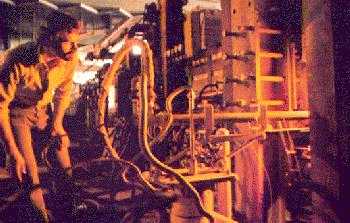

A private sector glass factory near Ghazvin

The Iranian "economic miracle" in the Pahlavi era was well known. Although the dramatic rises in oil revenues that oc- curred in 1973 and 1974 highlighted the country's economic wealth and potential for development, the Iranian economy had been achieving very high growth rates for each of the previousi ten years, for reasons only partly connected with oil.

The economy was a truly mixed one. While the important oil and gas sector was publicly owned, agriculture remained almost entirely in the private sector, while industry and mining and services were fairly evenly divided between the public and the private sectors. The public sector accounted for almost exactly two thirds of total projected investment during the t Fifth Plan, but the private sector had in the sixties and seventies invested twice as much as the public sector in industry and mining.

A useful way of examining the structure of the Iranian economy is to note the changing interrelationships between the three distinct sectors into which it can conveniently be divided. These are the oil sector, the modern sector (non-oil industry and services) and the agricultural sector.

Basically, the oil sector provides the capital required for the growth of the other two sectors, thus sparing Iran from the most serious constraint that has always inhibited the growth of developing countries. The modern sector draws on the oil sector for its capital and on the agricultural sector for its labour and raw material requirements.

As it grew, the modern sector was increasingly able to supply its own capital requirements, and turned to the oil sector as a source of raw materials and energy. Being based on a finite and depleting resource, the oil sector would have gradually merged into the rest of the economy and finally diminished altogether. By then, however, the modern sector would have been self-sufficient enough to provide for its own capital and energy needs, and its exportable surplus of production would taken over the role of the oil sector as the main supplier of the nation's foreign exchange needs. Anyway, that was the idea... and it was working.

As for the agricultural sector, it would have shrunk in manpower terms but increased in productivity, so that the increasing demands of the growing population could have been met without diverting the resources needed by the modern sector for its growth. In other words the creation of a totally modern agriculture was envisaged in subsequent years.

Despite the undeniable supremacy of the oil sector, it is worth noting that the Iranian economy was relatively well-balanced, at least in comparison with most Middle East oil-producing nations. Oil only overtook agriculture in terms of contribution to gross domestic product in 1972.

In that year the relative contributions to GDP by each sector were agriculture 18.1 per cent, oil 19.5 per cent, industry and mining 22.3 per cent and services 40.1 per cent. By the end of the Fifth Plan period these ratios were expected to be agriculture 8.0 per cent, oil 48.7 per cent, industry and mining 16.1 per cent and services 27.2 per cent, still a comparatively well-balanced structure.

Looking back to the past ,we may note that during the Fourth Plan (1968-73) Iran's GNP rose in real terms at an average annual rate of 12 per cent, and gross domestic investment averaged an increase of over 15 per cent. In 1973 and 1974 GNP increased even more spectacularly, by 34 per cent and 42 per cent, but these were exceptional rises resulting from very large upward adjustments in oil prices that were unlikely ever to be repeated on such a scale. In 1975 GNP grew by 23.8 per cent.

Throughout the 1960's this growth was accompanied by what now seems exceptional price stability. For most of this period inflation was extremely low, but towards the end of the decade it rose to 3.5 per cent a year. Then in 1972 the rate went up to 6.3 per cent.The following year to over 11 per cent. By 1975 price rises, partly due to "imported" inflation and partly to excessive liquidity, had become so intolerable that urgent action was required and strict price control measures succeeded in lowering somehow the prices of most consumer goods to acceptable levels.

Planning became well-entrenched principle of Iran's development. The First National Development Plan was launched as early as 1948. The Fifth Plan, covering the period March, 1973, to March, 1978, had a strong emphasis on social welfare programmes, particularly in the field of education and health. The Government's very large revenues meant that no sector needed I suffer from a shortage of funds. While rapid, balanced and sustained economic growth was a major objective, it was not to be achieved at the cost of high inflation, inequitable distribution of wealth or damage to the environment or the nation's cultural heritage. In other words, growth for growth's sake was not the objective.

During 1974 the need to revise the original Fifth Plan, because of substantially increased oil revenues, became apparent. The revised Fifth Plan projected total Government revenues during the Plan period at about $122 billion, with the oil sector providing about 80 per cent of this. During 1975 lower world demand and the failure of the international oil consortium that purchases the bulk of Iran's oil exports to honour its commitments resulted in a shortfall of about $3 billion in actual oil revenues. Although Iran's balance of payments and reserves were still healthy and substantial the effect of this was for Iran to postpone certain development projects until the Sixth Plan, to cut back partially on its generous foreign aid programme, and to return to the international capital markets for a small part of its requirements for development funds. But these moves were nothing more but a temporary change of pace in the overall tempo of the country's development. In 1979 Iran had more than $16 billion in foreign reserve currency. Part of these assets are now frozen.

In 1973 Iran's main planning agency was renamed Plan and Budget Organization (PBO) to reflect the increasing emphasis on strict budgetary control. Under that system, Government agencies made their requests for funds for the year beginning the following March 21st, during the summer months, and the draft Budget was presented to the Majlis in the autumn, giving Parliament ample time to debate it before implementation.

The Budget bill was in two parts, a final revision, upwards or downwards, of funds payable to the Government agencies in the light of actual events, and target for next year. This process had led to greater efficiency in the utilization of funds and the smooth progress of development projects.

Despite a rate of population growth of about three per cent annually, personal incomes rose very rapidly. Per capita income rose from $532 in 1972 to $1,344 in 1974 and $1,456 in 1977, and was projected to reach $2100 by 1980.

The increase in oil revenues led to a massive rise in imports and since 1974 Iran's ports and land frontiers suffered severe congestion, the resulting demurrage and storage fees adding considerably to the end-cost of imported goods. Imports increased 77 per cent in 1974 to exceed $6.6 billion, following a rise of 45 per cent the previous year. The projected value of imports in the final year of the Fifth Plan is $9 billion. Iran was the largest market in the Middle Fast, with a volume of imports considerably greater than that of any country in the region.

At this juncture, Iran's plans to become a major exporter of non-oil goods werenot yet been realized, and in fact the value of exports had declined in real terms. The world recession and port congestion had adversely affected the export programme, but the main reason was been rising domestic consumption which did bit deeply into the exportable surplus of most goods. This trend was not expected to continue, however, and as Iran's industrialization would have gathered momentum, a wider range and greater volume of exports were foreseen. Already, manufactured and processed goods were accounting for an increasing share of Iranian exports, and the vast potential for chemical and petrochemical exports were just beginning to be. In 1974 the export of manufactured goods for the first time exceeded in value that of both carpets and cotton, traditionally the country's leading export items. Iran's long-term strategy was to become self-sufficient in consumer durables and non durables and to become a net exporter of nonoil goods by the time the petroleum resources are finally depleted.

Foreign investment played a major part in Iran's economic development planning. The criteria for evaluating investment proposals were different from those applied in most developing countries, and the emphasis was on the foreign partner being able to provide advanced technology and management rather than finance, which was readily available from domestic credit and investment sources. In cases where a project was export-oriented or had substantial long-term export potential, as in the case of the petrochemical industry, international marketing ability was another essential condition. The Fifth Plan projection for long-term foreign private investment in Iran was $2.5 billion, more than eight times the corresponding figure for the Fourth Plan.

The Iranian banking system continued to grow in size and sophistication. At its apex was Bank Markazi Iran, the bank of issue, which was responsible for the overall supervision of banking and monetary affairs. Bank Melli Iran, established by Reza Shah in 1925, (click here to look new money issue) was not only the largest commercial bank in Iran but among the top 80 banks in the world in terms of assets. After remaining static for about a decade, the number of banks began to increase again in the early 1970's and by 1979 there were 36 banks. Of these, 9 were owned by Iranian Government agencies, 13 were owned entirely by private Iranian interests, 13 were joint ventures between Iranian and foreign interests, and one was entirely foreign owned.

In terms of activities, 22 banks may be described as commercial while the remainder were specialized financial institutions devoted to the development of a specific economic sector such as industry, agriculture or housing, or geographic region. Branch banking spreacd rapidly, and banking services were available universally in towns and cities, and increasingly in rural areas, where the economy was becoming more and more monetized.

In addition to these commercial and specialized banks the number of representative offices of foreign banks also increased rapidly since 1974. By mid-1976 these numbered 52 and included representatives of some of the best-known names in international bank mg as well as several merchant banks specializing in project and corporate finance, advisory services and business intelligence. Iranian Banks had branches in all major cities of the world.

Other financial institutions in Iran included a number of domestic insurance companies and representatives of foreign insurance companies, and several firms providing specialized brokerage or investment services. A stock market was operating in Tehran since 1967, but until 1974 on a very limited scale. By then, as a sequel to the various measures aimed at broadening the base of industrial ownership, business in equity shares was increasing rapidly, and there was also an active market in a wide range of Government bonds.

Typifying the growing sophistication in investment trends was the recent promotion of two investment companies by a consortium of 29 Iranian banks. Named the Iranian Banks Investment Company and the Iranian Banks Construction Investment Company, the two firms seeked to encourage investment in productive enterprises, particularly housing, industrial and agricultural projects.

Two-thirds of the capital, with a nominal value of $42 million, was provided by the banks and one-third by the public.

The Rial, formerly linked to the dollar and then to the SDR, maintamed enviable stability in a period of wild currency fluctuations. Currency controls was abolished, but Bank Markazi Iran had on several occasions acted promptly to prevent speculative moves against the Rial.

In conclusion, the overall outlook for the Iranian economy, despite the uncertainties inherent in our world which inevitably exerted an influence on this country, could have been extremely bright. With many comparative advantages, such as its abundant resources of energy, manpower and raw materials, the economy could have continue its rapid upward trend and in less than a decade or so, Iran could have become be a full-fledged member of the advanced family of nations.